Imagine living in one of the world’s most vibrant cities, where luxury meets innovation. Dubai, with its breathtaking skyline and thriving economy, offers a unique opportunity for you to secure your future.

The Dubai Golden Visa is your ticket to long-term residency, and property investment could be your golden key. You’ll discover how investing in Dubai’s real estate market not only enhances your portfolio but also opens doors to a lifestyle many only dream of.

Are you ready to explore the steps and benefits that come with securing your Golden Visa through property investment? Keep reading, and we’ll guide you through every detail you need to know.

Credit: www.instagram.com

Dubai Golden Visa Basics

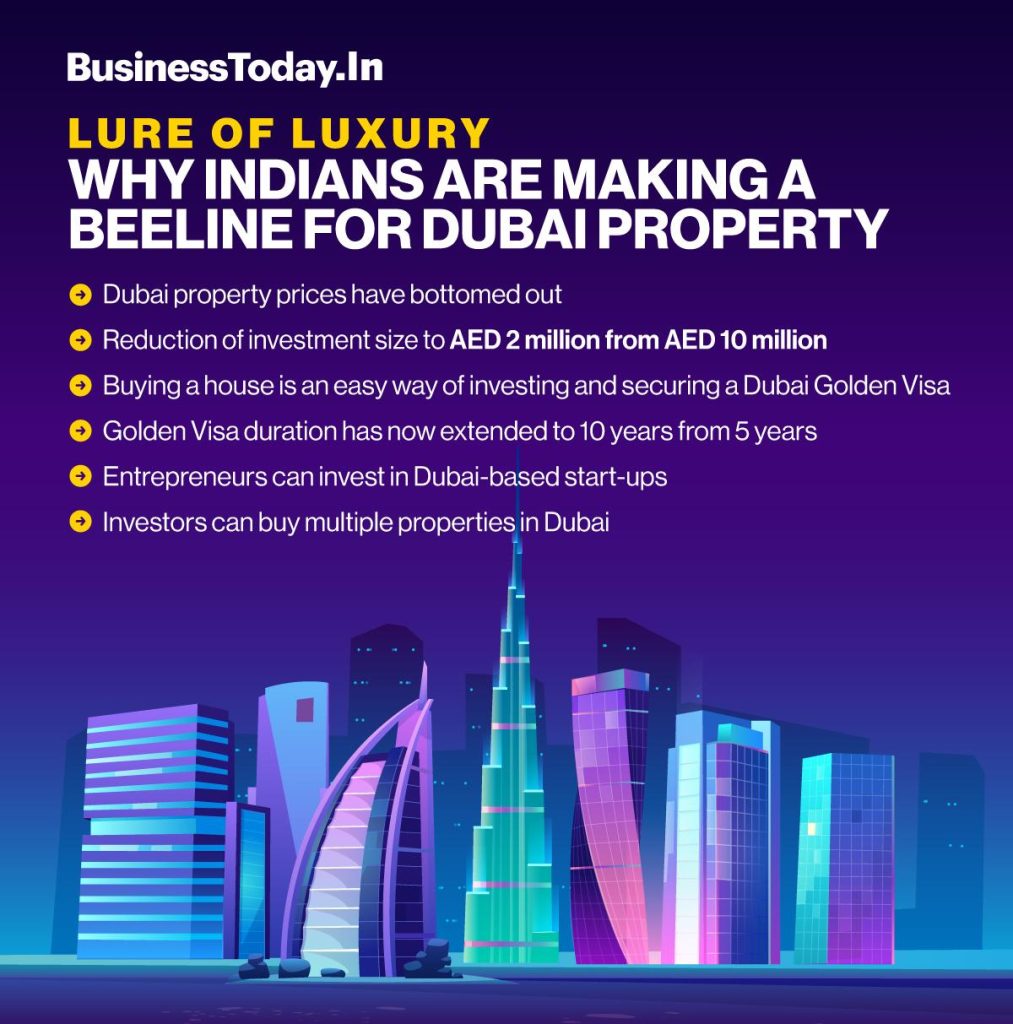

The Dubai Golden Visa has been gaining attention as a pathway to long-term residency in the UAE, attracting global investors and entrepreneurs. If you’ve ever dreamed of living in a city that seamlessly blends tradition with modernity, understanding the basics of the Dubai Golden Visa can be your first step. It’s an exciting opportunity, especially for those considering property investment as a means to secure this coveted residency status.

What Is The Dubai Golden Visa?

The Dubai Golden Visa is a long-term residency visa introduced by the UAE to attract talent, investment, and innovation. Unlike typical visas, it offers extended residency options ranging from five to ten years.

This visa isn’t just about staying longer. It’s about creating stability and fostering growth in a vibrant city. Imagine having the freedom to pursue business opportunities without the frequent visa renewals.

Who Can Apply For The Dubai Golden Visa?

Dubai Golden Visa is accessible to various categories of individuals, including investors, entrepreneurs, and specialized talents. Property investors are among those eligible, provided they meet specific criteria.

Consider this: owning property in Dubai not only provides a potential return on investment but also opens doors to residency. It’s about combining investment with lifestyle.

Why Choose Property Investment?

Property investment is a strategic way to qualify for the Dubai Golden Visa. It offers a dual benefit: owning real estate in a booming market and securing residency.

Picture yourself owning a piece of Dubai’s skyline while enjoying the perks of long-term residency. Isn’t it intriguing how property can be a key to the city’s dynamic future?

How Much Investment Is Required?

To qualify for the Golden Visa through property investment, a minimum investment threshold must be met. This amount ensures that the investment is substantial enough to contribute to the local economy.

But what does this mean for you? It’s about making a calculated investment that not only meets visa criteria but also aligns with your financial goals.

Are There Any Restrictions?

While the Dubai Golden Visa offers numerous benefits, there are specific requirements and restrictions. These include the type of property and the minimum investment value.

Navigating these might seem complex, but with the right guidance, you can understand and meet these criteria. Wouldn’t it be great to have clarity on each step?

As you explore the possibility of the Dubai Golden Visa through property investment, think about the lifestyle changes and opportunities this could bring. Could this be your chance to thrive in a city that never sleeps?

Eligibility Criteria

Acquiring a Dubai Golden Visa through property investment is a dream for many seeking to enjoy the vibrant lifestyle and opportunities Dubai offers. But how can you determine if you’re eligible for this golden opportunity? Understanding the eligibility criteria is crucial. Let’s break it down to make it simple and achievable for you.

Eligibility Criteria: Investment Threshold

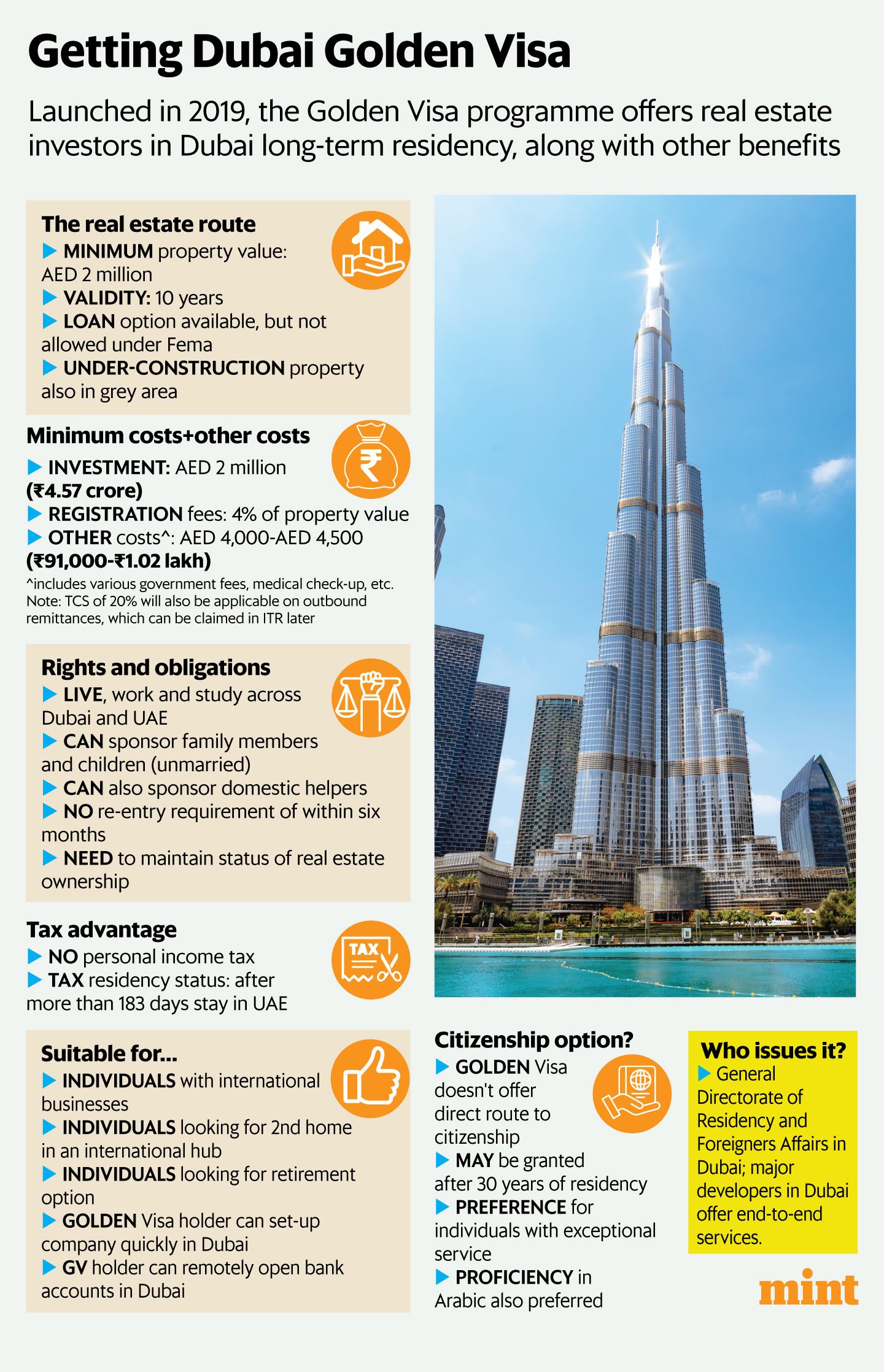

To qualify, you need to invest in a property worth at least AED 2 million. This sounds daunting, but think about the long-term benefits. Owning a property in Dubai not only opens doors to residency but also to a booming real estate market.

Eligibility Criteria: Property Type

Your investment should be in residential properties. You may wonder, why not commercial? Residential properties provide a stable and secure option for personal use and rental income. Plus, Dubai’s residential market is diverse, offering everything from luxurious villas to cozy apartments.

Eligibility Criteria: Title Deed

Having a title deed in your name is essential. This proves ownership and is your ticket to applying for the Golden Visa. Imagine holding a document that not only signifies your property but also a potential gateway to long-term residency.

Eligibility Criteria: Financing

Be aware that the entire investment amount should be non-mortgaged. This means you need to have the financial resources upfront. Are you prepared for this financial commitment? It’s essential to assess your financial situation before diving in.

Eligibility Criteria: Legal Compliance

Your property investment must comply with the legal requirements set by Dubai authorities. Do you know what these entail? Ensuring legal compliance is key to a smooth application process. Double-check all paperwork and regulations to avoid any surprises.

Eligibility Criteria: Investor’s Age

Investors need to be at least 18 years old. If you’re a young investor, this is your chance to make a substantial move early in life. Picture yourself starting your adulthood with a secure footing in one of the world’s most dynamic cities.

Understanding these criteria simplifies the path to your Dubai Golden Visa. Are you ready to take the plunge and secure your future in Dubai? The time to act is now!

Benefits Of The Golden Visa

Dubai’s Golden Visa offers many benefits to investors. This prestigious visa is a gateway to a wealth of opportunities. Those who invest in property can enjoy numerous advantages. Let’s explore some of these benefits in detail.

1. Extended ResidencyThe Dubai Golden Visa grants long-term residency. Investors can stay up to 10 years. No need to renew frequently. This stability allows you to plan for the future. Enjoy the peace of mind that comes with a secure residency.

2. Family SponsorshipGolden Visa holders can sponsor their families. This includes spouse, children, and parents. Your loved ones can live with you in Dubai. This benefit makes relocating much easier for families. It strengthens family bonds while living abroad.

3. Business OpportunitiesDubai is a hub for global business. The Golden Visa provides a great chance to explore new ventures. Network with international professionals. Access a vibrant market with endless possibilities. Grow your business with confidence.

4. Tax AdvantagesDubai offers a tax-free environment. Golden Visa holders benefit from this financial advantage. No personal income tax means more savings. This makes Dubai an attractive destination for investors.

5. High-Quality LifestyleDubai is known for its luxurious lifestyle. The city offers world-class amenities and services. Enjoy a high standard of living. From shopping to dining, the options are endless. Experience a comfortable and vibrant lifestyle.

6. Security and SafetyDubai is one of the safest cities in the world. The Golden Visa ensures you can enjoy this security. The city has a low crime rate. This makes it a safe place for you and your family.

Credit: www.facebook.com

Investment Thresholds

Dubai’s Golden Visa offers a gateway to long-term residency through property investment. Understanding the investment thresholds is key to securing this opportunity. These thresholds determine eligibility, making it crucial for potential investors. Let’s explore the key details.

Investment Threshold For 10-year Visa

The 10-year Golden Visa requires a minimum property investment of AED 10 million. This can be through a single property or a portfolio. It’s essential that the investment is free of any loans. The property must be retained for a minimum of three years.

Investment Threshold For 5-year Visa

For a 5-year visa, the minimum property investment is AED 5 million. Like the 10-year visa, the investment should be loan-free. The property needs to be held for at least three years.

Eligible Property Types

Not all properties qualify for the Golden Visa program. Only residential properties are eligible. Commercial properties do not count towards the investment thresholds. Ensure the property is completed and ready for occupancy.

Property Valuation And Documentation

Accurate property valuation is crucial for visa eligibility. Obtain a certified valuation report. Ensure all property documents are in order. This includes the title deed and sales agreement.

Joint Ownership Rules

Joint property ownership is possible for Golden Visa eligibility. Each investor must meet the minimum investment threshold. The property’s total value must reflect the combined investment requirement.

Types Of Properties Eligible

Investing in Dubai real estate can lead to a Golden Visa. Not all properties qualify, though. Understanding which types of properties are eligible is crucial. This knowledge helps make informed investment decisions.

Residential Properties

Residential properties are common choices for investors. These include apartments, villas, and townhouses. The property must meet the minimum investment threshold set by authorities. Freehold areas are popular among foreign investors. They offer full ownership rights. This makes them an attractive option for Golden Visa seekers.

Commercial Properties

Commercial properties also qualify for the Golden Visa. This category includes offices, retail spaces, and warehouses. Investing in commercial real estate can be lucrative. It often yields higher returns. Ensure the property meets the required investment value. This is essential for visa eligibility.

Mixed-use Properties

Mixed-use properties combine residential and commercial spaces. These properties offer diverse investment opportunities. They attract both tenants and businesses. The investment value must still meet the required threshold. Mixed-use properties provide flexibility in usage and potential income streams.

Off-plan Properties

Off-plan properties are under construction or planned. They present an opportunity to invest early. Purchasing off-plan properties can be cost-effective. The investment value is often lower than completed properties. Ensure the developer is reputable and the project is approved. This ensures eligibility for the Golden Visa.

Real Estate Market Overview

Dubai’s real estate market is dynamic. It offers a mix of luxury and affordability. Investors find attractive opportunities here. The city has grown rapidly over the years. Its strategic location is a major draw.

Dubai is a hub for business and tourism. This attracts global investors. The real estate sector is a key part of the economy. Property values have seen steady growth. Both residential and commercial properties are in demand.

High Demand For Luxury Properties

Luxury properties are popular in Dubai. Many buyers seek lavish lifestyles. Areas like Palm Jumeirah and Downtown Dubai are hotspots. These locations offer stunning views and amenities. High-end villas and apartments are common choices.

Investment Opportunities In Emerging Areas

Emerging areas provide great investment potential. Dubai South and Jumeirah Village Circle are examples. These areas are developing fast. They offer affordable property options. Investors can expect high returns here.

Legal Framework And Regulations

Dubai has strong property laws. They protect investors and buyers. Regulations ensure transparency in transactions. The government supports foreign investment. This makes the market reliable and secure.

Factors Influencing Property Prices

Several factors affect property prices. Location is crucial. Proximity to schools, malls, and transport matters. Economic conditions also play a role. Interest rates and inflation impact prices.

Choosing The Right Property

Dubai offers unique opportunities for property investment leading to a Golden Visa. Investors should consider location, budget, and property type. Choosing wisely can secure residency benefits.

Choosing the right property is a crucial step in securing a Dubai Golden Visa through property investment. Your decision can significantly impact not just your visa application, but also your future in Dubai. From location to amenities, every detail matters.Understanding Market Trends

Location Is Key

Evaluate Property Types

Check The Developer’s Reputation

Focus On Return On Investment

Credit: x.com

Property Investment Process

Investing in property is a popular way to obtain the Dubai Golden Visa. It offers a tangible asset while opening doors to long-term residency. The process might seem overwhelming, but it’s quite straightforward once you break it down. Below, you’ll find the essential steps to guide you through the property investment process.

Understanding Dubai’s Real Estate Market

Grasp the dynamics of Dubai’s real estate market. It fluctuates, so timing your investment is crucial. Research current trends and forecasts to make informed decisions. Talk to real estate experts who can provide insights based on their experiences.

Setting A Budget

Your budget sets the tone for your investment journey. Decide how much you’re willing to invest. Factor in additional costs like maintenance fees and taxes. Consider how this investment aligns with your financial goals.

Selecting the right property is key. Is it a villa, apartment, or commercial space? Each has its pros and cons. Think about location, amenities, and potential return on investment. Would you prefer a bustling area or a quieter neighborhood?

Legal Requirements And Documentation

Navigating legal requirements is crucial. Ensure all your documents are in order. You’ll need identification, proof of income, and property-related paperwork. Consult with legal experts to avoid pitfalls and ensure compliance with UAE laws.

Engaging With A Real Estate Agent

A seasoned real estate agent can be your greatest ally. They know the ins and outs of the market. They can help you find properties that match your criteria and budget. How do you find a trustworthy agent who understands your needs?

Making The Purchase

Once you’ve chosen a property, it’s time to purchase. Negotiate the price and terms with the seller. You’ll need to secure financing if you’re not buying outright. Consider all payment options and choose what suits you best.

Applying For The Golden Visa

With your property secured, apply for the Golden Visa. Gather all necessary documents and submit your application. Ensure your property meets the minimum investment value required for the visa. How long will it take to process your application?

Embarking on this journey is not just about acquiring property but securing a future in Dubai. Each step requires careful thought and action. Are you ready to take this leap and become part of Dubai’s vibrant community?

Financing Options

Investing in Dubai property opens doors to obtaining a Golden Visa. This visa offers long-term residency benefits to investors. Various financing options make acquiring property easier for individuals seeking this prestigious visa status.

Investing in property to secure a Dubai Golden Visa is a significant decision, and understanding your financing options is crucial. Navigating the financial aspect can be daunting, but with the right guidance, you can find a path that suits your needs. Let’s delve into the various ways you can finance your property investment in Dubai and make your dream a reality.Traditional Bank Loans

Traditional bank loans are a popular choice for many investors. They offer structured repayment plans and competitive interest rates. Before choosing this option, assess your financial stability and creditworthiness. Consider approaching banks with a solid reputation in the UAE. They are familiar with the nuances of property investments for Golden Visas.Mortgage Financing

Mortgage financing is another viable option. It allows you to leverage your existing assets to fund your property purchase. Check if your preferred property is eligible for mortgage financing, as not all properties qualify. Some banks offer specific mortgage plans tailored to Golden Visa investors. It’s worth exploring these options to see if they meet your needs.Private Lenders

Private lenders might offer more flexible terms compared to banks. They often provide quicker approvals and personalized loan structures. However, they might come with higher interest rates. It’s essential to conduct thorough research on private lenders. Ensure they have a proven track record and positive client feedback before committing.Self-financing

If you have enough savings, self-financing might be the most straightforward path. It eliminates the need to deal with banks or lenders. This option gives you full control over your investment. However, ensure that this doesn’t strain your financial situation. It’s wise to keep a safety net for unforeseen expenses.Property Developer Plans

Some property developers in Dubai offer financing plans to attract Golden Visa investors. These plans can include deferred payment options or interest-free periods. Research developers with a strong presence in the market. Their financing plans can be more accommodating than traditional lenders. When considering your financing options, it’s important to reflect on your long-term goals. Which option aligns best with your financial plans? Can it support your lifestyle in Dubai? Ensure that the decision you make today builds a secure future for you and your family.Legal Requirements

Investing in property in Dubai can lead to obtaining a Golden Visa. This visa offers long-term residency to investors and their families. Understanding the legal requirements is crucial for a successful application.

Understanding The Minimum Investment Amount

To qualify for the Dubai Golden Visa, invest at least AED 2 million in real estate. The property must be completed and not under mortgage. This investment secures your eligibility for the visa application.

Property Ownership Conditions

Only freehold properties qualify for the Golden Visa. Ensure your property is in a designated freehold area. Ownership must be under the investor’s name, not through a company or entity.

Eligibility For Family Members

Your family can also benefit from the Golden Visa. Spouse and children can obtain residency. Ensure their details are included in your application.

Required Documentation

Prepare all necessary documents for your application. This includes the property title deed, passport copies, and proof of investment. Accurate documentation speeds up the application process.

Application Submission Process

Submit your application through the Dubai Land Department. Use their online portal for convenience. Follow the guidelines to ensure a smooth application process.

Government Fees And Charges

Be aware of the fees involved in the application process. Fees vary based on the type of visa and number of applicants. Budget for these costs to avoid surprises.

Application Process

Investing in Dubai property can qualify you for a Golden Visa. To apply, purchase property worth at least AED 2 million. Ensure all documents meet requirements, then submit your application through the Dubai Land Department.

Embarking on the journey to secure a Dubai Golden Visa through property investment can be both exciting and rewarding. Understanding the application process is crucial to ensure a smooth experience. With the right steps and insights, you can navigate the process with ease and confidence.Understanding Eligibility Requirements

Before diving into the application, ensure you meet the eligibility criteria. You must invest in a property worth at least AED 2 million. The property should be ready and not off-plan, meaning it must be completed and handed over.Gathering Necessary Documentation

The application requires specific documents. These include a valid passport, property deed, and proof of investment value. Ensure these documents are up-to-date and accurate.Submitting Your Application

Once your documents are ready, submit your application to the Dubai Land Department. This can be done online through their official portal. Double-check all entries to avoid delays.Application Review And Approval

After submission, your application undergoes a review. This process can take a few weeks. Stay patient and keep your contact information updated for any follow-ups.Receiving Your Golden Visa

Upon approval, you will receive your Golden Visa. This is a significant milestone, offering you long-term residency benefits. Celebrate this achievement and plan your future in Dubai. Engaging in this process might seem daunting, but breaking it down into manageable steps makes it achievable. Have you ever wondered how securing a Golden Visa could transform your life? With this knowledge, you’re one step closer to making it a reality.Documentation Needed

Securing a Dubai Golden Visa through property investment requires specific documentation. Essential papers include a valid passport, property ownership proof, and a completed visa application form. Ensure you have bank statements and a good conduct certificate to streamline the process.

Obtaining a Dubai Golden Visa through property investment can be a rewarding journey, but it requires the right set of documents to ensure a smooth process. Knowing what documents you need can save you time and prevent unexpected hurdles. Let’s explore the essential paperwork required for this prestigious visa.Proof Of Property Ownership

You’ll need to provide official proof that you own property in Dubai. This includes a title deed issued by the Dubai Land Department. The property must meet the minimum investment criteria, currently set at AED 2 million.Valid Passport Copy

A clear copy of your passport is essential. Ensure that it has a minimum of six months’ validity. A friend of mine almost missed the deadline because his passport was about to expire—don’t let this happen to you!Good Conduct Certificate

A Good Conduct Certificate from the Dubai Police is a must. It confirms that you have a clean legal record in the UAE. You can apply for this certificate online, making it a convenient step in your application.Proof Of Income

Demonstrating stable income is crucial. This could be in the form of bank statements or salary slips from the past six months. This document shows that you can support yourself while residing in Dubai.Health Insurance

Obtaining health insurance is not just a requirement but also a wise decision. It ensures you have access to healthcare services in Dubai. Research different insurance providers to find a plan that suits your needs.Property Valuation Report

A valuation report from a certified real estate appraiser is necessary. This report confirms the current market value of your property. It’s an essential document to verify that your investment meets the visa requirements. Do you have all your documents ready? Missing even one can delay your application process. Preparing these documents in advance can help you focus on the more exciting parts of relocating to Dubai. Remember, each piece of paper is a step closer to living in one of the world’s most dynamic cities.Timeline For Approval

Dreaming of making Dubai your second home through a Golden Visa via property investment? Understanding the timeline for approval is crucial. While it may seem daunting, with a clear grasp of the process, you can streamline your journey to securing a golden ticket to one of the most dynamic cities in the world. Let’s break down the timeline so you know what to expect.

Understanding The Application Process

Before diving into the timeline, familiarize yourself with the application process. You need to submit your property documents, proof of ownership, and personal identification. The key here is accuracy—any mistakes can delay approval.

The Initial Review Stage

Once you’ve submitted your application, it enters the initial review stage. Typically, this takes about two to four weeks. During this period, officials verify your documents and ensure they meet all requirements. Keep your phone handy; sometimes, a quick clarification can speed things up.

Approval Notification

If your application passes the initial review, you’ll receive an approval notification. This is usually via email or a phone call. Imagine getting that call while sipping coffee, and suddenly, Dubai feels a lot closer.

Final Documentation And Visa Issuance

After approval, you need to provide final documentation to obtain your visa. This includes health insurance and biometric data. This step can take another two to four weeks. Ensure you’ve got your paperwork ready to avoid any last-minute rush.

Factors Affecting The Timeline

Several factors can affect how quickly your visa is approved. The property value plays a significant role, with higher investments often fast-tracked. Your application’s completeness and accuracy also matter. Would you like your journey to be as smooth as possible?

Personal Experience: Patience Pays Off

A friend of mine invested in Dubai property last year. Initially anxious, he meticulously followed the steps. By the end of two months, he was holding his golden visa, ready to embrace the opportunities Dubai offers. His patience and attention to detail paid off—yours can too.

Conclusion: A Strategic Approach

While the timeline can vary, a strategic approach ensures you stay on track. Monitor your application status closely and respond promptly to any queries. Are you ready to make Dubai your second home? Your golden journey awaits.

Common Challenges

Navigating Dubai’s Golden Visa application through property investment presents challenges. High property costs and complex legal requirements often confuse investors. Understanding local market trends is essential for a successful application.

Investing in Dubai’s real estate market to secure a Golden Visa can be a lucrative opportunity, but it’s not without its hurdles. Navigating through the challenges can be daunting, especially if you’re unfamiliar with the process. Understanding these challenges can help you better prepare and increase your chances of success.Understanding Real Estate Market Dynamics

Dubai’s real estate market is fast-paced and ever-changing. Prices can fluctuate significantly, affecting the value of your investment. Keeping up with market trends is crucial to make informed decisions. It’s essential to research and consult experts who can provide insights into the current market conditions.Identifying The Right Property

Choosing the right property is more than just finding a visually appealing space. You must consider location, potential for appreciation, and rental yield. Properties in popular areas might be expensive, but they often promise better returns. Weigh the pros and cons carefully before deciding.Navigating Legal And Regulatory Requirements

Dubai has specific legal requirements for foreign investors. Understanding these regulations is crucial to avoid legal complications. You may need to engage a local legal advisor to guide you through the paperwork. Ensure all your documents are in order to avoid delays in the visa process.Managing Financial Commitments

Investing in property involves significant financial outlay. You need to have a clear understanding of the costs involved, including taxes, maintenance, and management fees. Consider your budget carefully and ensure you have a financial cushion for unforeseen expenses. Are you financially prepared for this commitment?Understanding Cultural Differences

Dubai’s culture can be very different from what you may be used to. Understanding these cultural nuances can affect your investment decisions. For instance, certain customs may influence property demand in various neighborhoods. Learning about the local culture can help you make more informed choices.Securing The Golden Visa

The process of obtaining the Golden Visa can be complex. Each step requires careful attention to detail. Any oversight could lead to delays or even rejections. Stay organized and keep track of all requirements to streamline your application process. Encountering these challenges is part of the journey towards securing a Golden Visa through property investment in Dubai. With preparation and the right mindset, you can navigate these obstacles effectively. What strategies will you use to overcome these challenges?Tips For Successful Application

Explore the benefits of property investment in Dubai for obtaining a Golden Visa. Ensure eligibility by investing in qualifying real estate. Gather all necessary documents to streamline the process.

Embarking on the journey to secure a Dubai Golden Visa through property investment can be both exciting and challenging. With the right insights and preparation, you can navigate the application process smoothly. Here, we’ll explore some practical tips to enhance your chances of success. Whether you’re a seasoned investor or new to Dubai’s vibrant real estate market, these pointers will help you make informed decisions.Research The Market Thoroughly

Understanding Dubai’s real estate landscape is crucial. Dive into the current trends, popular neighborhoods, and property values. Visit properties in person, if possible, to get a sense of the location and amenities. Utilize online resources and local real estate agents for updated insights.Select The Right Property

Choosing the right property is key. Look for properties that not only meet the Golden Visa requirements but also have potential for appreciation. Consider factors like proximity to key areas, infrastructure development, and community amenities. A property that fits your lifestyle and investment goals is ideal.Prepare Your Documents Meticulously

Having your paperwork in order is essential. Gather all necessary documents such as passport copies, property deeds, and financial statements. Double-check for completeness and accuracy. Missing or incorrect documents can delay your application process.Engage With Reliable Professionals

Seek guidance from reputable real estate agents and legal advisors. They can provide valuable advice and ensure your application meets all the criteria. Their expertise can help you avoid common pitfalls and streamline the process.Monitor Application Status Regularly

Stay proactive by keeping track of your application’s progress. Regularly check for updates and be ready to respond to any inquiries from authorities. Being responsive demonstrates your commitment and can expedite the process.Reflect On Your Investment Goals

Consider what you aim to achieve with this investment. Is it primarily for residency, or are you looking for long-term returns? Understanding your goals will help you make decisions aligned with your personal and financial aspirations.Be Patient And Persistent

The application process may take time. Stay patient and persistent. Use any waiting period to further acquaint yourself with Dubai’s lifestyle and investment environment. This patience can lead to informed decisions that benefit you in the long run.Leverage Personal Experiences

Learn from others who have successfully obtained the Golden Visa through property investment. Their stories can offer insights that are not found in official guides. You might discover unique strategies or overlooked aspects that can enhance your application.Ask Yourself Critical Questions

What makes this property a good fit for you? How does it align with your future plans? Reflecting on such questions can provide clarity and guide your decisions throughout the application process. Approaching the Dubai Golden Visa through property investment with these tips can set you on a path to success. It’s about making informed choices, preparing thoroughly, and staying engaged throughout the process. How will you ensure your application stands out?Maintaining Visa Status

Investing in Dubai property can qualify you for the Golden Visa, granting long-term residency. Purchase real estate worth AED 2 million or more. Ensure property ownership aligns with visa requirements for successful application.

Maintaining your Dubai Golden Visa status after acquiring it through property investment requires ongoing attention and strategic planning. It’s not just about the initial investment; it’s about understanding the visa’s requirements and ensuring you remain compliant. This section will guide you through the essential steps to keep your visa active and secure your residency in Dubai.Understand The Renewal Process

To keep your Golden Visa active, you must renew it periodically. The typical validity period is ten years, but renewal is not automatic. You need to prove that your property investment meets the visa’s criteria at renewal time. Be prepared to show updated documents and any changes in your property value. Regularly check the current requirements, as they can change.Ensure Property Compliance

Maintaining compliance with the property investment criteria is crucial. Your investment should remain at or above the required threshold. If property values dip, you might need to consider additional investments to meet the visa’s requirements. Consider monitoring the real estate market trends in Dubai. This will help you make informed decisions and keep your investment value within the visa’s criteria.Stay Informed About Policy Changes

Dubai’s immigration policies can shift, impacting Golden Visa requirements. Staying informed about these changes is vital. Regularly consult official government websites or engage with professional advisors who specialize in UAE visas. Think about subscribing to newsletters from reputable sources. This can provide timely updates and insights into any new policy developments.Leverage Professional Advice

Engaging with a local real estate advisor or immigration consultant can be invaluable. They can offer insights into maintaining your visa status and navigating any bureaucratic challenges. An advisor can help you strategize your investments. They can also guide you through the renewal process and ensure your property portfolio remains compliant.Maintain Residency Requirements

Dubai Golden Visa holders must adhere to residency requirements. This usually means spending a certain amount of time in the UAE each year. Failing to meet these requirements can jeopardize your visa status. Plan your travel and residency strategically. Consider splitting your time between Dubai and other locations to meet the residency criteria.Engage With The Community

Building connections in Dubai can enhance your visa experience. Engaging with local communities, business networks, and social groups can provide support and resources. Active participation can lead to valuable friendships and business opportunities. It can also help you stay informed about any local issues affecting your visa status. Do you feel prepared to navigate these steps for maintaining your visa status? It’s all about proactive management and strategic planning.Renewal Procedures

The Dubai Golden Visa offers long-term residency benefits for investors. Property investment is a popular way to obtain this visa. It’s important to understand the renewal procedures. Keeping your visa active ensures you maintain your residency privileges.

Understanding The Renewal Timeline

Golden Visas typically last for five or ten years. Remember the expiration date. Start the renewal process months before it expires. This ensures a smooth transition without residency interruption.

Required Documentation For Renewal

Gather necessary documents early. A valid passport is essential. Property ownership proof is crucial. Ensure all documents are up-to-date. This speeds up the renewal process.

Renewal Application Process

Submit your renewal application online. Use the official Dubai government portal. Follow instructions carefully. Double-check details before submission. This minimizes errors and delays.

Fees Associated With Renewal

Expect fees for the renewal process. Check the latest fee structure online. Prepare funds in advance. Understand all costs involved. This helps avoid last-minute surprises.

Seeking Professional Assistance

Consider hiring a visa consultant. They offer guidance through the process. Consultants ensure all requirements are met. This can save time and reduce stress.

Staying Informed About Policy Changes

Government policies can change. Stay updated with the latest regulations. Follow official announcements. This ensures compliance with current requirements.

Impact On Lifestyle

Dubai’s Golden Visa offers a unique opportunity for property investors. It not only opens doors to residency but transforms lifestyle in remarkable ways. This visa provides stability, access to luxury, and a vibrant community. Discover how this visa impacts daily life and future prospects.

Benefits Of Stability

Obtaining the Golden Visa ensures long-term residency in Dubai. This stability allows investors to plan their lives with certainty. Families can settle and enjoy consistent living conditions. It also means a reliable environment for career and business growth.

Access To Luxurious Amenities

Dubai is famed for its luxury offerings. Golden Visa holders enjoy access to exclusive amenities. High-end shopping centers, gourmet restaurants, and world-class entertainment are at their doorstep. This access enhances everyday living with comfort and style.

Vibrant Community Engagement

Dubai is a melting pot of cultures. Golden Visa holders become part of this diverse community. They engage in cultural events and social activities. Networking opportunities abound, enriching personal and professional connections.

Enhanced Travel Opportunities

Dubai’s strategic location offers travel advantages. Golden Visa holders can easily explore nearby regions. Frequent flights and connections make international travel seamless. This opens doors to global experiences and adventures.

Tax Implications

Investing in property to secure a Dubai Golden Visa can be appealing. But understanding the tax implications is crucial. This ensures a smooth experience.

Understanding Uae’s Tax Environment

The UAE offers a tax-friendly environment for investors. There is no personal income tax. This makes it attractive for many. Property investors enjoy several benefits.

Property Tax Considerations

Property buyers in Dubai pay a one-time fee. This is a 4% transfer fee. It applies to the property’s purchase price. There are no annual property taxes. But investors should be aware of other potential costs.

Rental Income Tax

There is no tax on rental income in Dubai. Investors keep more of their earnings. This is a major advantage for property investors.

Value Added Tax (vat) On Property

Residential property sales are generally VAT-exempt. But commercial properties have a 5% VAT. Understanding these nuances is important for investors.

Tax Implications For Foreign Investors

Foreign investors may face taxes in their home country. It’s essential to consult with a tax advisor. This ensures compliance with international obligations.

Double Taxation Treaties

The UAE has treaties with many countries. These prevent double taxation. They offer relief to international investors. This makes Dubai an attractive investment hub.

Tax Planning Strategies

Smart tax planning can optimize returns. Consider consulting with experts. They can guide you in structuring your investments wisely.

Future Of Dubai Golden Visa

Exploring ways to obtain a Dubai Golden Visa through property investment unveils promising opportunities. Investing in real estate can secure long-term residency in Dubai. This pathway combines financial growth with lifestyle benefits in a dynamic city.

The Future of Dubai Golden Visa is shaping up to be an exciting prospect for investors worldwide. As Dubai continues to grow as a global hub, the Golden Visa offers a unique opportunity to secure residency through property investment. The city’s vision for the future is clear—attracting talent, fostering innovation, and strengthening its economy. As you consider investing in Dubai property, you might wonder how this aligns with your long-term goals. Could this visa be your gateway to a vibrant lifestyle and promising investment returns?How Property Investment Drives Economic Growth

Dubai’s real estate market is booming, with investments driving economic growth. Property investment not only secures your Golden Visa but also contributes to the city’s infrastructure and development. Your investment helps build new communities and enhances urban living.Long-term Benefits For Visa Holders

Holding a Golden Visa opens doors to a myriad of benefits. It offers stability, access to world-class amenities, and a thriving business environment. Many investors have found that this visa provides a sense of security and belonging in Dubai’s dynamic landscape.Adapting To Global Changes

Dubai is known for its adaptability and foresight. With the Golden Visa program, the city is preparing for global changes by attracting professionals and investors. As a visa holder, you are part of a forward-thinking community that embraces innovation and diversity.Exclusive Opportunities For Property Owners

Owning property in Dubai gives you access to exclusive opportunities. From elite networking events to cultural gatherings, being a Golden Visa holder means you are part of a select group. Your property investment is not just a financial decision; it’s an entry into a vibrant lifestyle.Potential Challenges And Solutions

While the future looks bright, there are challenges to consider. Real estate markets can be unpredictable, and understanding local regulations is crucial. Equip yourself with knowledge and resources to navigate these challenges effectively. Seek advice from experts and connect with other investors to stay informed. The Dubai Golden Visa through property investment is not just a residency option; it’s a strategic move into a promising future. How will you leverage this opportunity for your personal and financial growth?Frequently Asked Questions

What Is Dubai Golden Visa?

Dubai Golden Visa is a long-term residency permit. It is granted to investors, entrepreneurs, and professionals. This visa offers benefits like business stability and family security. It allows holders to live, work, and study in UAE. It’s a great option for property investors looking for permanent residency.

How Much Property Investment Is Needed?

To qualify for the Golden Visa, invest AED 2 million in real estate. The property must be completed, not under construction. This investment should be free from any loans or mortgages. It must be a single property or multiple properties reaching the required value.

Can Family Members Get The Golden Visa?

Yes, family members can be included under the Golden Visa. Spouses and children can enjoy residency benefits. This ensures family stability and security in UAE. It’s one of the major advantages of the Golden Visa program for property investors.

Is Rental Income From Property Allowed?

Yes, rental income is allowed from your property investment. You can earn returns while holding the Golden Visa. Renting out your property can provide financial benefits. It’s a popular option among investors seeking income and residency.

Conclusion

Investing in Dubai property opens doors to the Golden Visa. This opportunity provides long-term residency. Benefits include security and a vibrant lifestyle. Choose properties wisely for best returns. Look for prime locations and trusted developers. Always check legal requirements. This visa can enhance your life and future.

Dubai offers a mix of modernity and tradition. It’s a place for growth and opportunities. Make informed decisions. Enjoy the benefits of living in a global city. Consider Dubai for a stable investment and a promising future. Your dream life in Dubai is within reach.